are delinquent property taxes public record

Personal Property is movable. City of Wayne Wayne County.

Delinquent Taxes Liens Multnomah County

Welcome to Erie County NY.

. Remember that regardless of record ownership delinquent taxes on real property may always be collected through foreclosure on the real property itself. Failure to redeem the property within this time period will result in tax foreclosure and the sale of the property at auction. Flathead County does not send an additional statement for the May 31st 2nd installment of Real Estate Taxes.

Louis MS 39521-2428. Bidder registration begins 2 weeks prior to. Search Use the search critera below to begin searching for your record.

Parcels in bankruptcy are not subject to foreclosure action or to any. The Delinquent Tax Division investigates and collects delinquent real and personal property taxes penalties and levy costs. The Tax Office accepts full and partial payment of property taxes online.

If you have delinquent taxes due you will receive your uncertified document back with your check and a tax statement showing the delinquent taxes due. For Reno County such sales usually occur in the fall of each year. Delinquent Property Tax Deadline Approaching.

Real Property Parcel Search. Search Use the search critera below to begin searching for your record. Delinquent Personal Property Online Payment Service.

For an official record of the account please visit any Tax Office location or contact our office at 713-274-8000. Personal Property Real Property is immovable property such as land and buildings attached to the land. In our ongoing effort to prevent residential and commercial property foreclosures Oakland County residents and business owners with.

Delinquent property tax cannot be paid online. Interest of 56 of 1 per month plus 2 penalty must. When property taxes go unpaid or are delinquent for a period of time this is recorded by the tax assessor or tax collector.

Chautauqua County Foreclosed Property. Use our online system to pay your current City of Buffalo Erie County Property Taxes or delinquent Erie County Property Taxes for any Town or City in Erie County. All deeds in Saratoga County are recorded in the Saratoga County Clerks Office.

Once you receive the certified. Once a property tax bill is deemed delinquent after March 16th of each year a 15 past due penalty is added to the bill and the bill is sent to the Delinquent Tax Office. Internal Revenue Service IRS Equalization Rates.

Delinquent tax records are handled differently by state. Delinquent Personal Property Online Payment Service. Deed filings must also include a completed TP-584 and RP-5217 equalization form.

Property tax is delinquent on April 1 and is subject to penalties and interest. Typically a tax lien is placed on the property by the government when the owner fails to pay the property. City of East Lansing Ingham County.

Pay Delinquent Taxes Real Property vs. Records on this site reflect all unpaid delinquent property taxes penalties and interest fees for the properties listed. Because of the number of bidders we normally have attending our tax sale it is strongly encouraged you pre-register to be a bidder.

View the Public Disclosure Tax Delinquents List Business and individuals who owe more than 25000 in taxes to Massachusetts are posted on an online public list. Thats the key to this real. A tax lien is a legal claim against real property for unpaid municipal charges such as property taxes housing maintenance water sewer demolition etc.

Tax AssessorCollector Annex Office 854 Highway 90 Suite C Bay St. Hancock County Tax Assessor Post Office Box 2428 Bay St. Its public record too.

An owner whose property is. Finds and notifies taxpayers of taxes owed. Delinquent payments must be.

Personal Property Real Property. Real Property Tax Services. Public Records Delinquent REAL Tax Information Public Records Delinquent PERSONAL Tax Information Legal Description Search Real Property vs.

How To Find Tax Delinquent Properties In Your Area Rethority

Tax Collector County Of San Luis Obispo

Property Taxes Fort Bend County

Delinquent Tax Account Listing

Beaufort County Treasurer Begins Delinquent Property Postings This Week

Property Tax Alabama Department Of Revenue

Delinquent Property Tax Department Of Revenue

Everything You Need To Know About Getting Your County S Delinquent Tax List Retipster

Everything You Need To Know About Getting Your County S Delinquent Tax List Retipster

Statement Of Prior Year Taxes Los Angeles County Property Tax Portal

Current Payment Status Lake County Il

How To Get Delinquent Property Tax Penalties Waived Update State Covid Waiver Program Has Ended County Of San Luis Obispo

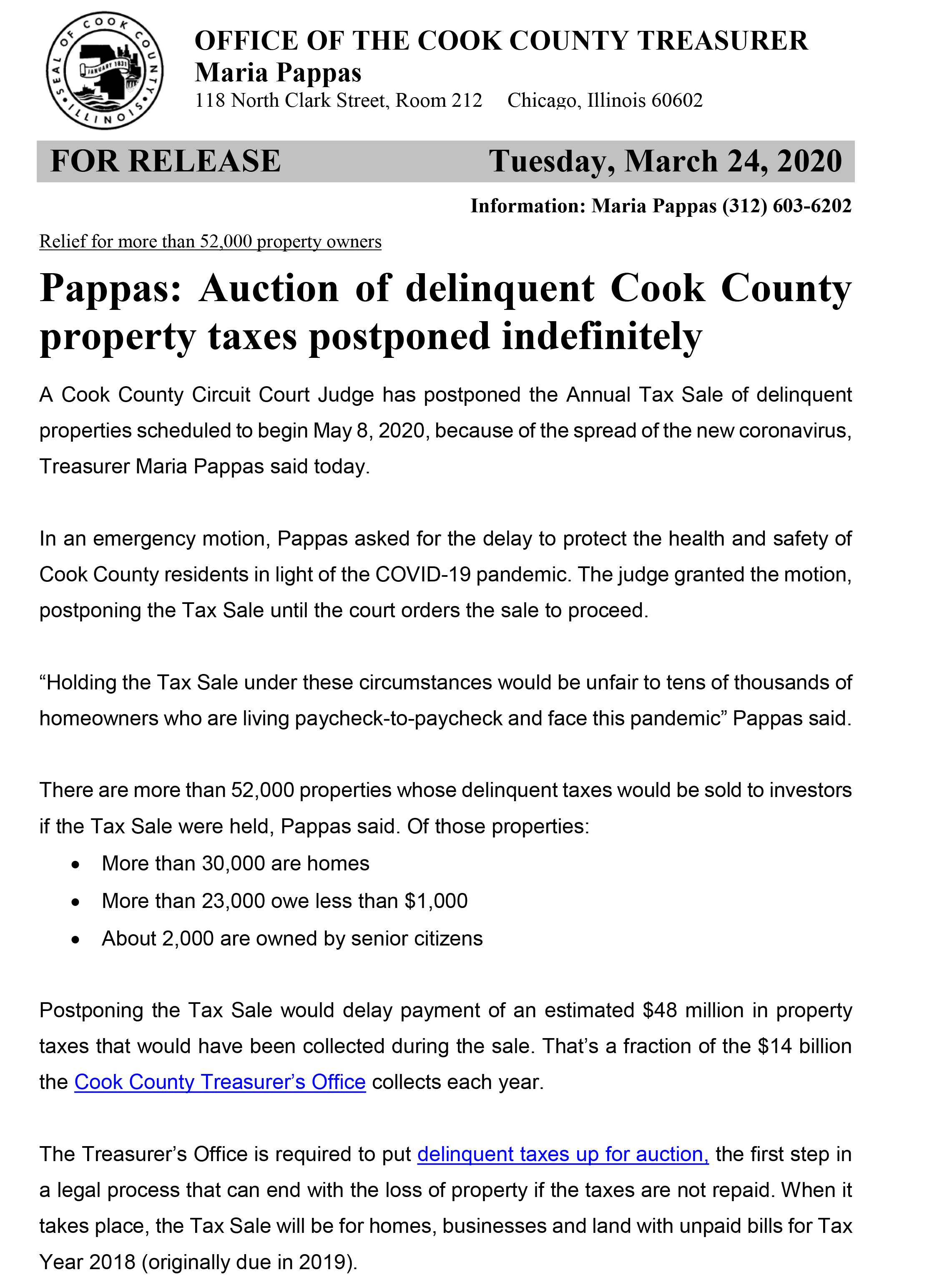

Pappas Auction Of Delinquent Cook County Property Taxes Postponed Indefinitely Alderman Tom Tunney 44th Ward Chicago

Harris County Officials Publish List Of Delinquent Taxpayers Houston Public Media